What to expect (or not) on Form 1099-DA for 2025 sales and exchanges

Overview

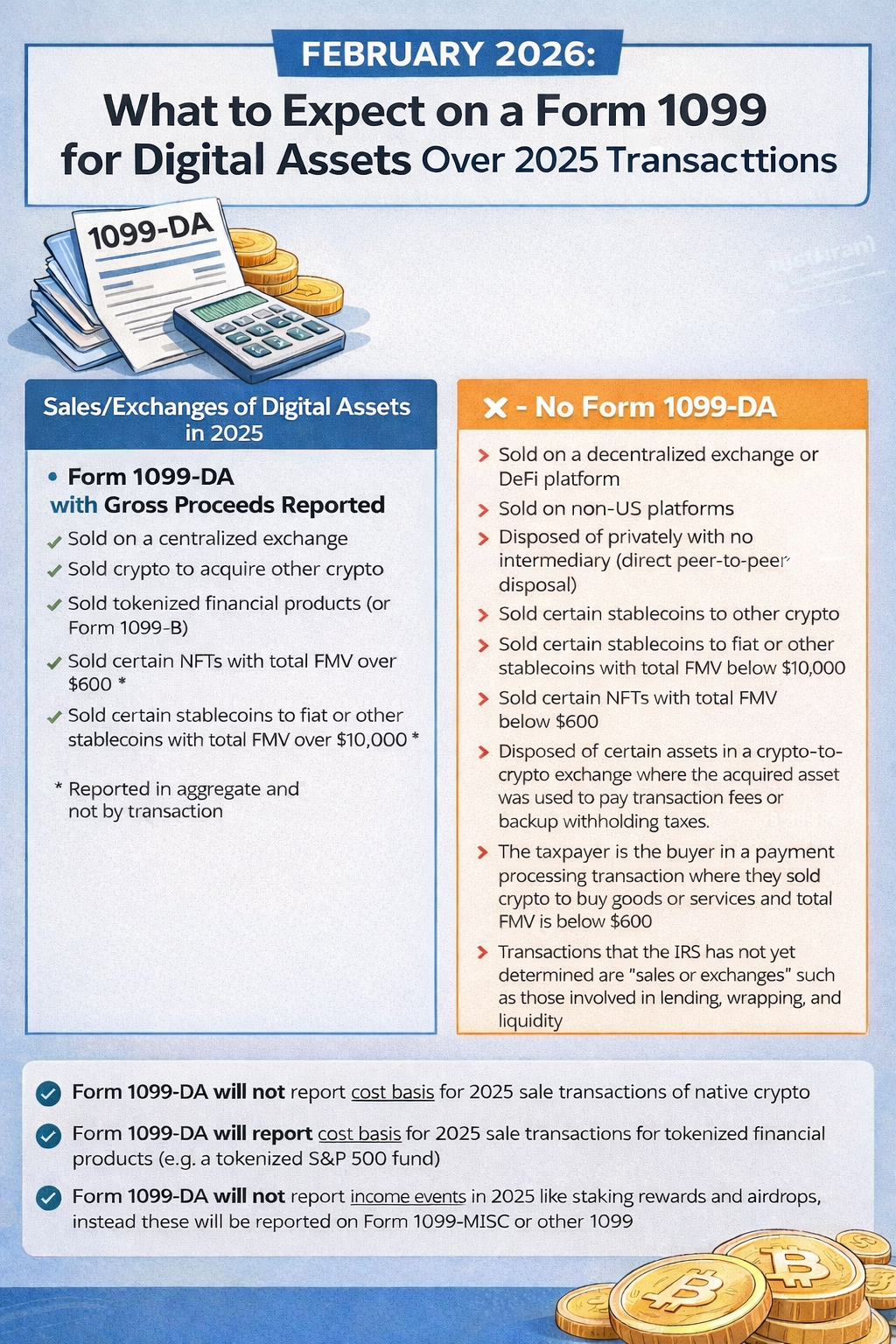

For the first time ever, US taxpayers will receive a Form 1099-DA reporting sales or exchange transactions of digital assets including stablecoins, native crypto, and NFTs. The requirements are complex for brokers to comply with and include a multi-year phase in. This unfortunately causes confusion for taxpayers and their advisors looking for reliable and consistent tax reporting. I have made the below chart to help tax advisors and preparers navigate what Forms 1099 to expect for the 2025 tax year, and how complete to expect them. For the nerdy tax advisors that would like more of the detail and nuance, you can read the whitepaper I published on the final regulations here.

How can Dune Consultants help?

Contact us today to discuss at info@duneconsultants.com. Or you can jump in the calendar for an introduction call.