CARF and DAC8 Have Arrived

From 1 January 2026 new customers at UK or EU crypto platforms are being asked for their tax residency and other personal data. Similar to the information that traditional financial institutions already ask their customers (e.g. banks, custodians of stocks/shares).

For existing customers, they will slowly see their accounts locking them out until they provide the requested information. Customers at platforms outside of the UK and EU Member States will experience this in future phases as CARF rolls out globally over the next few years.

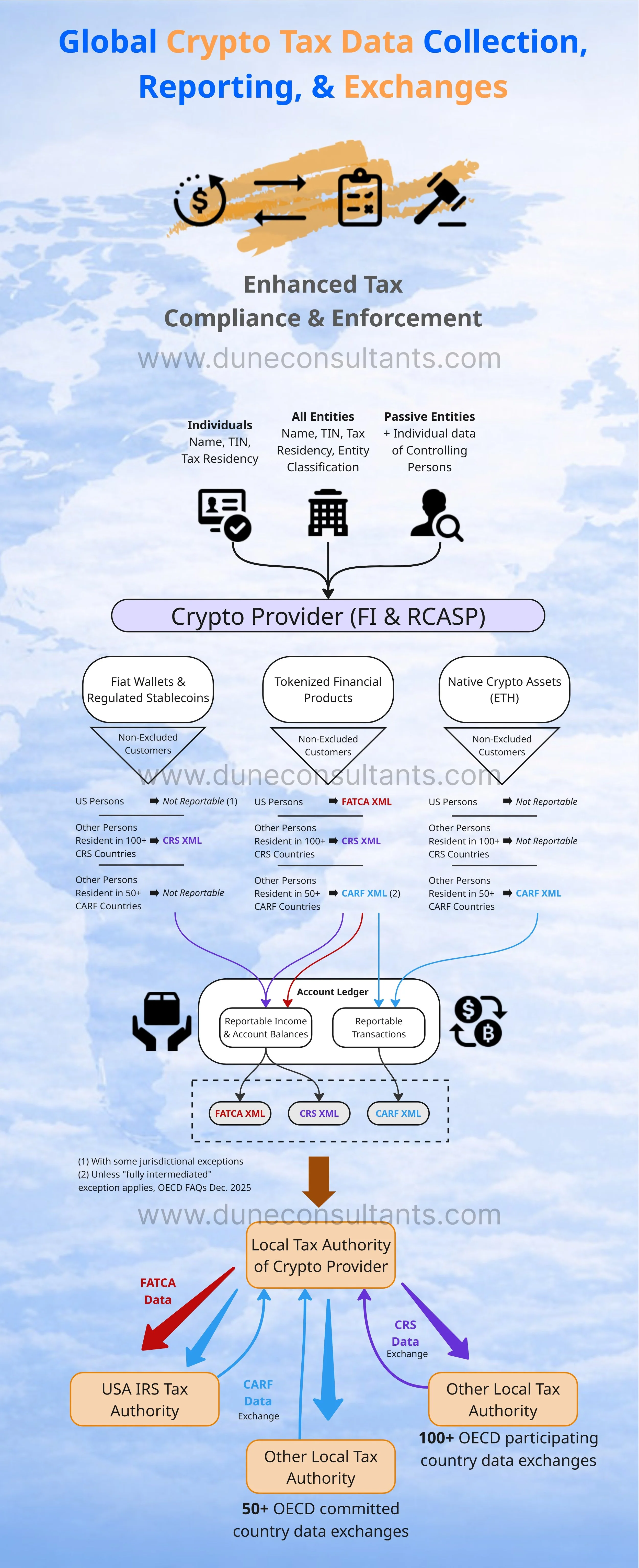

But CARF isn't just CARF. And tax data exchanges are not just crypto assets. Crypto and digital asset providers must navigate FATCA and CRS to understand the various products that may trigger tax reporting depending on their function and geography.

The below diagram simplifies a visual representation of the flow of tax data, using a crypto provider that has fiat e-money wallets (typical for centralized exchanges offering fiat on/off ramps), stablecoins that are SEMPs (only potentially USDC in the EU for now), native crypto (BTC ETH), and tokenized financial products (tokenized securities). This diagram also assumes the eventual participation of the United States in CARF. Draft regulations are currently in White House review.

For the tax nerd noticing that the FATCA arrow is one directional, indicating non-reciprocal exchange, this has long been an issue with FATCA Intergovernmental Agreement (IGA) exchanges: US Financial Institutions are not required to report account balances on Form 1042-S which severely limits the ability of the US Internal Revenue Service (IRS) to send equivalent data back to other jurisdictions about their tax residents that are using institutions/platforms in the US.

How can Dune Consultants help?

Contact us today to discuss at info@duneconsultants.com. Or you can jump in the calendar for an introduction call.