CARF and DAC8 Have Arrived

January 1, 2026 has ushered in the launch of the CARF and DAC8 tax reporting framework for crypto and digital assets in the UK and EU Member States. Customers will start being asked for their personal tax information, such as their tax residency and identification number, so that crypto providers can annually report their transactions to the local tax authorities. The CARF and DAC8 aim to enhance tax compliance and enforcement globally for crypto assets.

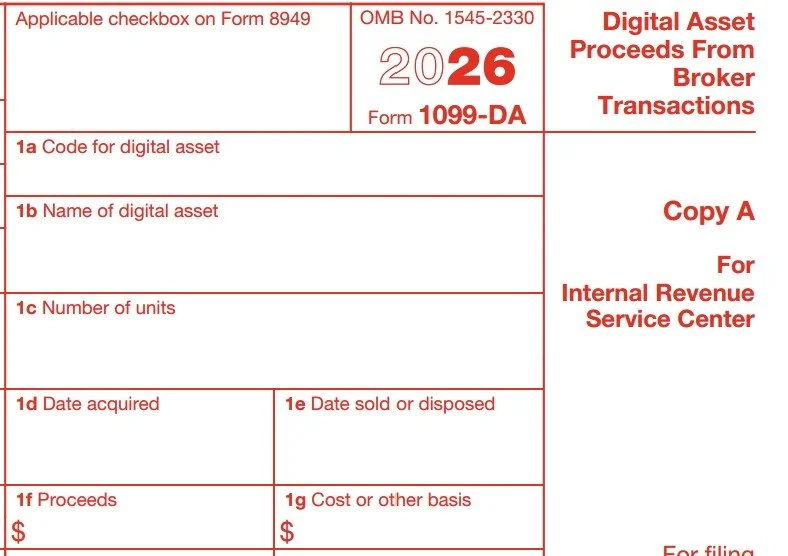

What to expect (or not) on Form 1099-DA for 2025 sales and exchanges

In July 2024 the US saw the publishing of the final regulations for reporting of sales or exchanges of digital assets on a Form 1099-DA. Now it has arrived. First Forms 1099-DA will be arriving in taxpayer inboxes in February 2026.

You may owe tax for just holding a spot ETH or spot BTC exchange traded fund (ETF) in 2024

In January 2024 the US saw the launch of the first spot bitcoin ETFs followed later in the year by ethereum ETFs. These ETFs add a new layer of tax complexity for investors who need to pickup their allocable share of fund-level crypto sales for gain/loss calculation purposes. And they won’t get a Form 1099 for this activity.

Implementing regulation for DAC7 equivalency fails to address different definitions of “residence”

On April 13, 2023 the EU adopted the implementing regulation for establishing the criteria for determining whether the information automatically exchanged under an agreement between the tax authorities of Member States and a non-EU country is equivalent to that specified in Council Directive (EU) 2021/514 (“DAC7”). But it seems that the implementing regulation left open more issues than expected. In today’s blog we explore one of the key issues left open: addressing equivalency with regards to the definition of “residence”.

Prepare for the ETH2 staking reward tax bill

The Shanghai upgrade to the Ethereum network is slated for March 2023 and many crypto enthusiasts could be in for an unexpected tax bill. Though the tax treatment of ETH2 staking rewards varies from country to country, in the US there is a widely held interpretation amongst tax advisors that ETH2 staking rewards were not taxable in past years as the taxpayer did not have dominion and control over the income. With the Shanghai upgrade, taxpayers will obtain dominion and control over their ETH2 and a taxable event will be triggered, regardless if the taxpayer actually unstakes their ETH2 or not. Today’s blog looks at how taxpayers and their advisors can prepare for this event.

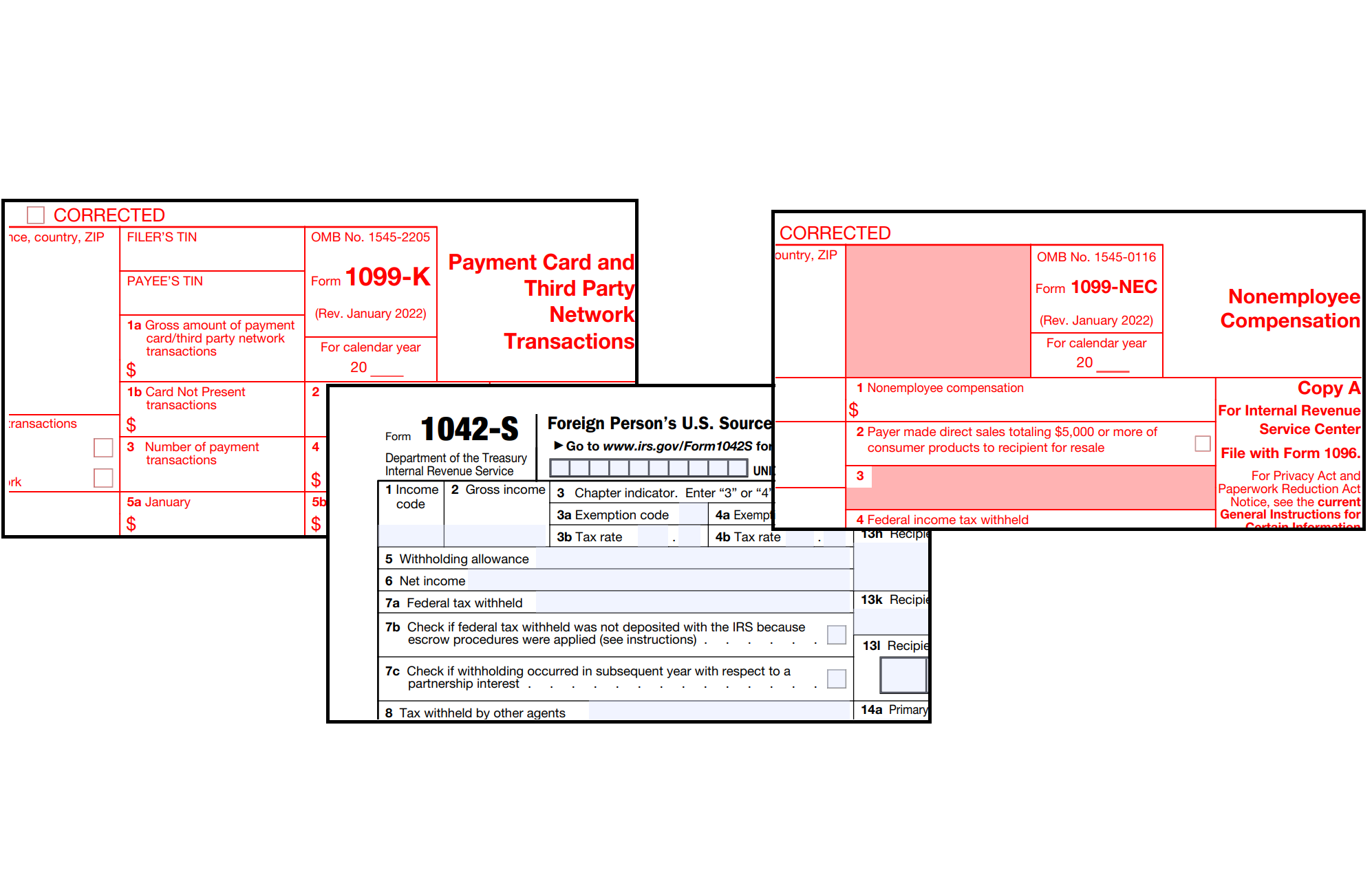

Blockchain validators may not be off the hook for all US tax reporting

Much of the US Form 1099 reporting is due in January and February, which is just around the corner. Now is a good time for blockchain validators to check their US tax reporting obligations. Many news reporters incorrectly state that upcoming legislation may exclude proof-of-stake blockchain validators from US IRS Form 1099 reporting (amongst other players in the industry, like miners). But this is a misleading claim. While validators are expected to be excluded from the definition of “broker” for sales and transfers of digital assets on Form 1099-DA, they could still have existing obligations for Form 1099 reporting of staking income or rewards that they pay to other parties.

Why crypto Self-Directed IRAs are getting 1099ed

Self-Directed Individual Retirement Accounts (“SD IRAs”) have become all the rage in the US since crypto entered the main stream and became widely viewed as an investable asset class. SD IRAs give you the power to invest retirement funds in diverse assets like real estate and crypto. But there is a danger lurking under the hood: your SD IRA crypto may be sitting inside of an account that will issue you Forms 1099-MISC or even Forms 1099-B at the end of each year. If your SD IRA is receiving Forms 1099 today, and presumably not paying the tax on the reported income, then your SD IRA is setting itself up for an IRS audit risk. Today’s blog explores why this Form 1099 reporting is happening and the outlook for future.

Form 1099-K myths debunked

Form 1099-K is a lot less settled than we believed. Many businesses incorrectly think that if they pay their vendors with Stripe that they don’t need to do their own Form 1099 reporting. And many gig/marketplace platforms incorrectly think that if they have Form 1099-K reporting then this extinguishes any Form 1042-S reporting to foreign payees. We dig into these myths to keep you better informed and reduce the chance of duplicate or under-reporting.