Crypto debit card tax reporting is coming

Published: November 14, 2022

Summary

Prepaid debit cards have historically escaped annual account balance reporting under Common Reporting Standard (CRS) as they were explicitly carved off as not being a Depository Account. Debit cards that referenced a regular checking or savings bank account were not specifically carved off as they debit funds from a Depository Account that was already in scope of CRS (e.g. a traditional checking or savings account at a bank). Today’s blog explores how amendments to the CRS will bring prepaid debit cards into scope of annual reporting by causing the institution holding customer accounts to become a Depository Institution and the prepaid debit card to become a Depository Account. This blog also explores if, and how, the fact that it is marketed as a crypto debit card changes the reporting in consideration of the CARF.

At the end of the day, the CARF and CRS are frameworks recommended by the OECD. As such, this blog can really be viewed as a hypothetical discussion based on what we have been presented by the OECD. We will ultimately have to wait and see how each domestic implementation approaches this topic and what guidance is issued by governments regarding the treatment of crypto/prepaid debit cards.

What is the CARF and CRS, and how do they interact together?

I suggest to read an earlier blog about stablecoins, CARF, and CRS to get a quick lay of the land before returning here.

How do crypto debit cards work?

Let’s first start with a few other explanations:

Debit cards simply access funds held in one place and deduct an amount of money in order to be sent to pay for something (like a good or service). Most people think of the debit card on their checking/current/savings account at their traditional bank. But debit cards can debit other types of accounts.

Prepaid debit cards are not tied to a traditional bank account, but are instead pre-loaded with funds which can then be spent in most of the same ways as a debit card from a bank account. The funding can come from a wider variety of methods since it is not tied to a bank account, The holder cannot spend more than what is pre-loaded on the card. Popular prepaid debit cards in the traditional financial services world include the Wise prepaid debit card and some of the Revolut cards as well, both popular for travellers wanted to pre-load different currencies to spend.

Then crypto debit cards entered the market.

The need they fulfilled was from people that wanted to use crypto in their daily spending without the high friction of logging into their exchange or other wallet, selling their crypto for fiat, withdrawing the fiat to their traditional bank, and then spending their fiat via their debit card or pre-loading fiat onto their prepaid debit card. Crypto debit cards allow holders to conveniently skip most of those steps and spend crypto frictionlessly, while also offering rewards tied to crypto.

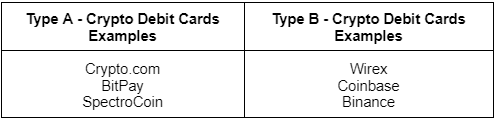

Crypto debit cards allow the holder to spend their crypto by simplifying the sale into fiat. In all cases that I found, the merchants (e.g. the coffee shop where you swipe your crypto debit card) is being paid in fiat. So do crypto debit cards actually hold crypto on them? No. I read the terms and conditions of a number of crypto debit cards on the market including from Wirex, Coinbase, Crypto.com, BitPay, Binance, SpectroCoin, and more and in all cases the card is a prepaid debit card and requires the sale of the holder’s crypto in order to fund fiat for the purchase that is being made. I found no crypto debit cards on the market today that actually do a transfer of crypto from the holder’s wallet into either the issuers crypto wallet or the merchants crypto wallet.

Two types of crypto debit cards

For discussion today, we can broadly fit these crypto debit cards into two types as follows:

Type A: a prepaid debit card that is manually pre-loaded with fiat currency in advance of purchases, by selling available crypto-assets first or transferring in fiat, resulting in the possibility to hold a sustaining fiat balance on the card

Type B: a prepaid debit card that sells crypto-assets on demand at the time of purchases, in order to fund the card with fiat currency and release the payment for purchases in the same transaction, resulting in the expectation that no sustaining fiat balance is carried on the card except for those caused by short delays in processing the load and release

In both Type A and Type B, any refunds to the card are always done in fiat currency and not crypto-assets.

Tax reporting under CARF and CRS of crypto debit cards

Below are presented a Type A and Type B example of how reporting might happen by exchange/custodians that also offer customers crypto debit cards. Prepaid debit cards, as they are only denominated in fiat currency, are expected to fall under the definition of Specified Electronic Money Products (SEMPs) described in the amendments to the CRS.

Update Note Added July 2025: The OECD has issued FAQs that may be interepreted to mean that the custody of BTC is not a CRS Custodial account. If this is confirmed by the OECD or domestic implementations of the guidance, then the Type B example below would not have a CRS reportable account balance under either the Custodial account or the Depository account.

It is important to note that not all marketers of crypto debit cards offer exchange or custodial services of crypto. These institutions would need to further assess if they are subject to CARF reporting or not. Most of their obligations related to the prepaid debit card itself would primarily land in the Depository Account reporting under CRS.

Some exclusions

In the example above, we used small numbers for the sake of simplification. However, there are some exceptions that institutions will consider as follows:

Products that are not SEMPs

In order for a product to be a SEMP, and therefore cause the institution to be a Depository Institution, it must be used for holding prepaid funds. An exception is therefore mentioned in the definition of SEMP as follows:

The term “Specified Electronic Money Product” does not include a product created for the sole purpose of facilitating the transfer of funds from a customer to another person pursuant to instructions of the customer. A product is not created for the sole purpose of facilitating the transfer of funds if, in the ordinary course of business of the transferring Entity, either the funds connected with such product are held longer than 60 days after receipt of instructions to facilitate the transfer, or, if no instructions are received, the funds connected with such product are held longer than 60 days after receipt of the funds.

This definition is confusing because it’s an exception which then contains an exception to the exception. The CRS commentary offers this example for this SEMP definition:

The definition excludes those products that are created solely to facilitate a funds transfer pursuant to instructions of a customer and that cannot be used to store value. For example, such products may be used to enable an employer to transfer the monthly wages to its employees or to enable a migrant worker to transfer funds to relatives living in another country. A product is not created for the sole purpose of facilitating the transfer of funds if, in the ordinary course of business of the transferring Entity, either the funds connected with such product are held longer than 60 days after receipt of instructions to facilitate the transfer, or, if no instructions are received, the funds connected with such product are held longer than 60 days after receipt of the funds.

In short, these transfers must be moves of money that are initiated by instruction of the holder/customer themselves. The use of a prepaid debit card to make purchases would not likely fit into this category since a purchase is not a transfer, and the purchase itself is typically initiated by the merchant at the point of sale.

SEMPs that are Excluded Accounts

So a prepaid debit card will typically be a SEMP and the institution holding it will be a Depository Institution. But then the institution must evaluate whether their customers have Financial Accounts that are reportable each year. The CRS amendments now contain a new type of Excluded Account as follows:

A Depository Account that represents all Specified Electronic Money Products held for the benefit of a customer, if the rolling average 90 day end-of-day aggregate account balance or value during any period of 90 consecutive days did not exceed USD 10,000 at any day during the calendar year or other appropriate reporting period.

This will require some data analytics on the part of the institution to determine which accounts are reportable Financial Accounts or Excluded Accounts each year unless their product by its design does not allow for a balance to be held above this value. In our example above, it seems most likely that the Type B crypto debit cards which exchange to fiat at the time of purchase would likely fit into this exclusion. So even if there was a balance in the Type B prepaid debit card at 12/31 then it may end up being an Excluded Account anyway. Institutions must keep in mind that any product which is intentionally designed or marketed in a way as to avoid being reported under CRS could be reportable under the EU DAC6 framework depending on the jurisdictions involved.

Conclusion

There are a lot of moving parts in the CARF and amendments to CRS. Crypto asset service providers will need to assess each of their product offerings against the frameworks to evaluate their exposure to CARF and CRS due diligence, reporting, and other obligations. Though the discussion above was focused on crypto prepaid debit cards, the same discussion affects other non-crypto related prepaid debit cards that were previously out of scope of CRS. New due diligence, reporting, and other CRS obligations will be a heavy lift to implement so preparations should begin now. Lastly, as the CARF and CRS are only a recommended framework, we will have to wait and see how local implementation adopts these recommendations. For example, some jurisdictions may not wish to adopt the Excluded Account threshold and others may make the threshold higher.

How can Dune Consultants help?

Contact us today to discuss at info@duneconsultants.com. Or you can jump in the calendar for an introduction call.